In the last year I have had the opportunity to sit down with some great minds in the economics and finance industries to discuss the present and future of the global economy. The glaring area that continues to resonate in my conversations is the underlying systemic issues with the United States economy and specifically the balance sheet. So much of our nations culture has moved to short term thinking which dictates the strategic direction of our economy, corporations and policy. This culture has created systemic issues in our country and also the global economy primarily through increased debt loads. We saw the first glimpse of this with the 2008 sub-prime crisis and continue to utilize short term tactics in order to drive short term results. Continuing on with this culture in our capital markets and policy will lead to bigger and more impactful recessions and crisis than the 2008 sub-prime. The below excerpt is from the reputable BCA research group that discusses the Debt Supercycle.

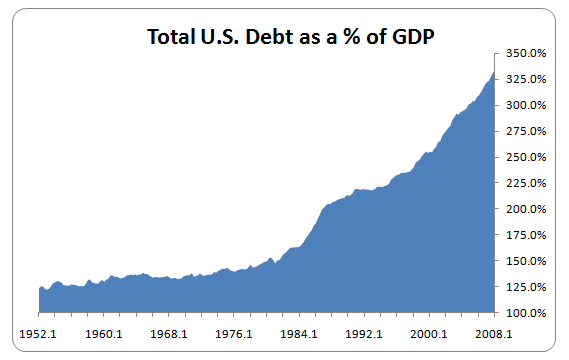

The Debt Supercycle is a description of the long-term decline in balance sheet liquidity and rise in indebtedness during the post WWII period. Economic Expansions have always been associated with a build-up of leverage. However, prior to the introduction of automatic stabilizers such as the welfare state and deposit insurances, balance sheet excesses tended to be fully unwound during economic downturns, albeit at the cost of severe declines in activity.

Government policies to smooth out the business cycle were successful in preventing the frequent depressions that plagued the pre-WWII economy, but the downside was that the balance sheet imbalances and financial excesses built up during each expansion phase were never fully unwound.

Periodic “cyclical” corrections to the buildup of debt and illiquidity occured during recessions, but these were not enough to reverse the long-run trend. Although liquidity was rebuilt during a recession it did not return to its previous cyclical high. Meanwhile, the liquidity rundown during the next expansion phase established new lows.

These trends led to growing, illiquidity, and vulnerability in the financial markets. The greater the degree of illiquidity in the economy, the greater is the threat of deflation. Thus, the bigger that balance sheet excesses become, the more painful the corrective process would be. So, the stakes have become higher in each cycle, putting ever-increasing pressure on the authorities to reflate demand, by whatever means are available. The Supercycle process is driven over time by building tension between rising underlying deflationary risks in the economy, and the ability of policymakers to create inflation.

The Supercycle appears to have reached an important point in the current cycle with the authorities reaching the limit of their ability to get consumers to take on more leverage. This has forced the government to leverage itself up instead. Once fiscal policy is pushed to the limits of sustainability, the Debt Supercycle could come to a violent end.

This is the stark reality that we are currently living in but no one in main stream media or politics will talk about. In my humble opinion leadership is making the difficult and unpopular decisions for the long term good of society. The United States has been on a 50 year trend of expanding at the expense of future generations. At some point in time we as a society must face what has been created and make the difficult decisions to unravel what prior generations created. This may result in difficult times but it will be for the greater good of future generations. Unraveling the United States debt would be a selfless act but one that must be done.