There are thousands of bureaucrats and politicians around the country that are touting their centralized economic development strategies as works of genius. But when you look under the hood of what is actually being said and done there is significant logical fallacies behind these efforts. The most common being circular reasoning and broken window fallacy but below are a handful of the common fallacies I have witnessed by politicians and economic development leaders.

- Appeal to fear fallacy – Argument appealing to fear and prejudice towards the other side.

- i.e. If we don’t attract out of state companies we will go back to high unemployment.

- Argument ad populum fallacy – Appeal to widespread belief, bandwagon argument.

- i.e. Every state is giving subsidies to recruit companies, therefore, we must give subsidies.

- Texas sharp shooter fallacy – improperly asserting cause to a cluster of data.

- i.e. Our economic development labor subsidy reduced cancer in our state.

- Appeal to consequences fallacy – The conclusion is supported by a premise that asserts positive or negative consequences from some course of action in an attempt to distract from the initial discussion.

- i.e. Positive headlines prove the economy is growing, positive headlines benefit business owners.

- Broken Window Fallacy – An argument that disregards lost opportunity costs.

- i.e. Tax credits spent to repair the economy was the best use of that tax payer money.

- Fallacy of a Single Cause – Assumption there is one simple cause for an outcome.

- i.e. Wages are stagnant due to a lack of diversity in the economy.

- Argument False Authority – Using an authority or experts claims as evidence to support the conclusion.

- i.e. Our internal government economist supports fixed rent for housing.

- Circular Reasoning Argument – The argument begins with the end.

- Sports stadiums drive economic growth, therefore, economic growth occurs as a result of sports stadium subsidies.

The above list is an important list to be aware of when the next smooth talking politician gives a speech or a government bureaucrat sends out a report stating an experts approval. A perfect example of the above fallacies is the subsidies given out to large technology companies to develop data centers. States have handed out over $2 billion in subsidies to the likes of Google, Apples, Facebook, and Amazon to lure the companies to build their data centers in their states.

Once a state is in contention for such a prize the politicians and bureaucrats get to work with their fallacious arguments outlining the great economic impact that comes with the subsidy price tag. Strong statements about revenue growth for education and job creation are promised to constituents. Empty promises by politicians are dolled out like candy in a parade, yet none of these politicians will be around to be held accountable for the results.

The champions of the deal promise they will easily pay for themselves in a few years and drive long term economic vitality. Trying to predict what will happen to an economy in one year let alone 10 plus years is the equivalent of trying to predict when and where the next Cat5 hurricane will hit. Any exercise in attempting this is political vanity and intellectually dishonest. I address this topic in more detail in my last post: The Problem of Big Data: An Epistemological Approach to Technological Advancement.

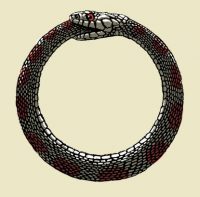

What we know now after the speeches and ground breaking ceremonies have faded into the past is that data centers deals did not do what they promised. A study from Good Jobs First states that it cost states $1.9 million per job on the mega data center deals. The long term economic vitality and job creation was filled by the very constituents that were being promised that the new companies would deliver. It really is circular reasoning at its finest, the snake eating its own tail.

The problem is political and bureaucratic leadership always has an answer to the problem which they likely created. It is either the need for raising minimum wage to increase wages or a need to invest in out-of-state companies to diversify our economy. Pick a talking point, there are many that are rinsed and repeated. The issue here is that pinning casualty to economic conditions is extremely difficult, if not impossible. No one is all knowing nor has the tools to assess all the variables to pin causality.

Economics is a social science and human behavior is highly unpredictable and complex. Simply stated, economies are not tested in controlled environments making it nearly impossible to pin causality or explain away any situation. And for that same reason it makes it very easy to throw any statement or data point out there because it cannot be tested in a lab. It gives politicians and bureaucrats an open check book to do whatever they want and find ways to justify the action regardless of the result.

This is where the logical fallacies run rampant in centralized economic development. This type of behavior would never be tolerated in the hard sciences. This is why self proclaimed economic development authorities around the country are nothing more than glorified politicians, not scientists, riddled with logical and economic fallacies.

French economist, Fredric Bastiat, eloquently explained this in his parable of the broken window in the mid 1800’s. This parable was used to demonstrate destruction in an economy and that the use of money to recover from that destruction is not a net benefit to society.

Bastiat referred to this as that which is seen and that which is not seen. He was explaining the impact of opportunity costs as well as the law of unintended consequences. Specifically, how the impacts of decisions “made for society” are often unseen or ignored. Therefore, macroeconomic data points can be misleading, breaking a window and replacing it raises Gross Domestic Product (GDP) but it is not a net benefit to our economy due to the lost opportunity cost.

You cold easily replace the broken window parable with that of the housing market, destroying a housing market and replacing it through quantitative easing and artificially low interest rates is not a net benefit to the economy.

A real world example of opportunity cost and unseen impacts is sports stadium financing. For decades the federal, state and local governments have subsidized sports stadiums in the tune of billions of dollars with the promise of renewed economic vitality. A Study conducted by Brookings in the late 1990’s found the following findings about sports stadium financing.

first, sports teams and facilities are not a source of local economic growth and employment; second, the magnitude of the net subsidy exceeds the financial benefit of a new stadium to a team; and, third, the most plausible reasons that cities are willing to subsidize sports teams are the intense popularity of sports among a substantial proportion of voters and businesses and the leverage that teams enjoy from the monopoly position of professional sports leagues.

The third point above illustrates the classic logic fallacy of popularity, it is playing to the emotion and popularity of the group and then using the fallacy of the single cause (economic vitality) to drive the conclusion. Unfortunately what is lost in this argument is the unseen inpacts and opportunity costs. Politicians and bureaucrats are taking complex systems that are highly unpredictable and trying to simplify them down to a single cause which is no different than putting tax payer money on red at the casino. Below is an excerpt from from a post at the Federal Reserve that illustrates what a simple opportunity cost calculation can do to change the potential conclusion.

In their critique, most economists highlight an important pitfall when considering the economic impact of stadiums: the failure to include opportunity costs. The opportunity cost is the value of the next-best alternative when a decision is made; it is what is given up. In the case of sports stadiums, both “seen” and “unseen” economic activity should be considered. The unseen spending, however, tends to be overlooked. Consumer spending at a sports stadium is easy to see—it is obvious and measurable. What is unseen, however, is how consumers would spend their dollars otherwise. If they were not spending on sporting events, they would instead spend on museums, movies, concerts, theater, restaurants, and so on. Because consumers tend to have limited entertainment budgets, dollars spent at a new stadium would not be new spending but rather diverted spending.

As citizens we should be skeptical of leaders pinning cause or using data gymnastics to push an agenda. No amount of empirical evidence could have properly warned us for the 2008 crash or that sports stadium subsidies would not drive economic growth because there was no prior data of such an event. In his book, Fooled by Randomness, Nassim Taleb stated that if the past, by bringing surprises, did not resemble the previous past to it (what I call the past’s past), then why should our future resemble our current past?

Naleb is a brilliant derivatives trader and statistician that understands the limitations of using historical or empirical data to predict future events or pin cause in complex systems like economies or weather. Bastiat and Naleb had humility in their ability to understand complex systems and for that reason they were perpetually open to being fooled by randomness. A quality I wish we would see more of in our leadership who seem to have an answer for every broken window.

Be aware of logical fallacies and those that use them to yield power over others, it is only our skepticism and accountability that can combat against these fallacies. The next time you hear a speech from a politician or read a report try to pick up on the fallacies, you will likely be shocked.

**Disclosure** In closing, it is not the effort to try to improve an economy or society that I take issue with, it is the arrogance that many carry when making decisions when they are utterly incapable of understanding the impacts or the variables. If more politicians and economic development authorities were actually intellectually honest about the nature of the complexity of the systems they are dealing with then I would respect that approach. Better yet, if they left this complexity and choices to the individual consumers and entrepreneurs in our economy. When complexity is too high, like what we see in economies, then I believe it is best to let each individual decide what is best for them.