“Bitcoin is a fraud that will eventually blow up. It’s worse than tulip bulbs. It won’t end well. Someone is going to get killed.” Jamie Dimon, JP Morgan CEO

This quote marks an important time in financial history, the CEO of a global banking institution making objective claims about cryptocurrency. What started as a white paper after the financial crash from a pseudonym, Satoshi Nakamoto, has turned into a $150 Billion market with over 800 cryptocurrencies. A technology that could literally displace the financial system and subsequently power and wealth like no other time in history. I do not think any of us could have predicted it would have led to this point, this fast.

With that said, I am consistently getting asked whether Bitcoin is a fraud or not. There are very smart people on both sides of the fence. One side stating it is a fraud while the other side stating it is the greatest financial innovation in history. The very fact that Bitcoin is creating so much dissension illustrates the disruptive nature of this technology. So which side of the fence is right?

Centralized vs. Decentralized

The answer comes down to perspective and where individuals ultimately put value and inherently trust. More specifically, do individuals collectively put more trust and value in a currency backed by centralized governments and banks or a decentralized system of peers backed by secure encrypted algorithms? Many would say that the growth of Bitcoin and other cryptocurrencies is showing the very transition of trust in centralized currency to decentralized currency. It is hard to deny the demand for a private currency that can not be manipulated by a government or central bank.

It is important to remember that currency has three distinct purposes – medium of exchange, store of wealth, unit of measurement. If this criteria is met then it can be utilized as currency. For example, a deck of playing cards could be used as currency. But ultimately this is decided collectively by individuals putting value and trust behind these functions. Therefore, there is nothing fraudulent about Bitcoin as a currency. It is used by millions of individuals daily as a store of wealth, medium of exchange, and unit of measurement.

The major sticking point for many and especially those that currently control currency and banking is the fact that Bitcoin is not controlled by a centralized source. This is terrifying for some and liberating for others. This is not a discussion of whether Bitcoin is fraudulent or not, this comes down to a discussion of whether collectively as individuals at this point in history we want to put our faith in a currency backed by a centralized system or decentralized system. Thanks to this new technology it is the first time in human history we have had the opportunity to make this choice as individuals.

The Wall Street Shuffle

Jamie Dimon’s comments illustrates his lack of understanding behind Bitcoin’s technology and network theory. Furthermore, his comments have multiple contradictions. Based on these contradictions I have to conclude that his comments are driven by either incompetence or fear.

Jamie Dimon: Governments look at bitcoin as a novelty from CNBC.

First Fallacy: Jamie states that Bitcoin will be used and is being used for illicit purposes and will eventually cause harm or death to individuals. This same claim can be stated about fiat currency, specifically the US dollar. According to the United Nations Office of Drugs and Crime, The money laundering industry is estimated to be approximately 2 to 5 percent, approximately $2 Trillion, of global GDP yearly. Think of the amount of harm and illicit activity that is going on with fiat currency compared to cryptocurrency at the moment.

To condemn the medium of exchange and not the act illustrates the weakness of the argument. Central banks and governments have not remotely been able to control illicit use of fiat currency and there is no evidence that this would be worse with Bitcoin or any other cryptocurrency. This is purely opinion until there is ample evidence to illustrate that decentralized cryptocurrency will produce greater percentage of illicit activity than fiat currency.

Second Fallacy: Jamie states that the government will shut down cryptocurrency once it causes harm (see first contradiction). Cryptocurrency is built on a fully distributed and decentralized network that allows for peer-to-peer transactions without the need of a financial intermediary nor government. Government can not shut down Bitcoin nor any decentralized cryptocurrency network. That is the very purpose behind the technology. Like China, governments can attack exchanges that are owned by centralized parties but this will only shift the demand to other safe havens.

According to an article by Hacked, China crytpocurrency traders are moving to South Korea and Japan where there is friendly regulation towards exchanges and cryptocurrencies. Government can slow distribution but they can not shut down distribution and the more they do the greater they will drive demand towards cryptocurrency. This is comparable to off shore banking and proves there will always be safe havens for cryptocurrency.

Third Fallacy: Jamie states that Bitcoin is good for countries like Ecuador and Venezuela where their currencies have collapsed. This is where confusion sets in for me, how can a currency be a fraud with regard to some countries yet good for other countries? Fraud is an objective claim that is binary, it is eit her fraudulent or it is not fraudulent. Jamie is right that Bitcoin is good for families in Venezuela and is keeping families from starving.

her fraudulent or it is not fraudulent. Jamie is right that Bitcoin is good for families in Venezuela and is keeping families from starving.

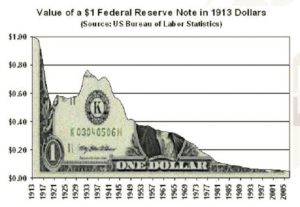

Comparably, the US Dollar has lost 95 percent of its purchasing power since the Federal Reserve was created in 1913. Central banks globally continue to devalue currencies through inflation to deal with overly leveraged debt-to-GDP ratios. Central banks are playing with fire through negative interest rates and increasing money supply. There is not a country in the world that could not become Venezuela or Argentina in the coming years.

Conclusion

Jamie Dimon is a Wall Street insider, JP Morgan has made billions off of centralized fiat currency and fractional reserve banking. It is in his best interest to defend this system and attack cryptocurrency. This should not be a surprise to anyone. The surprise is how quickly governments and Wall Street have become sensitive to cryptocurrency. This shows how much they view this technology and fully decentralized currency as a threat. Between China and Jamie Dimon’s comments I see this as the start of the war on cryptocurrency. I only ask that you keep Thomas Jefferson’s words in mind as you continue to hear the onslaught of attacks on Bitcoin and other cryptocurrencies in the coming years.

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered. I believe that banking institutions are more dangerous to our liberties than standing armies. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.” — Thomas Jefferson